B2B Transfers

International transfers should not be expensive and slow.

B2B Pay's mission

To make B2B transfers affordable, transparent and instantaneous.

Virtual bank accounts

VBAs are the best way to redefine the banking industry.

Our pricing model is based on two pillars:

Transparent, straightforward pricing

Lowest possible rates

We can perform payments from Europe to anywhere.

The Process

-

We simplify the paperwork

You provide us with the required documentation at sign-up. We go through a KYC/AML compliance check and ensure the banks and authorities involved receive the needed documentation.

-

We provide your business with an euro account with your IBAN number

With SEPA you can receive euro payments from 35 countries in Europe at no cost.

-

We immediately notify you

When your money arrives in the account and when we send the money to your local bank account for the best fee in the market.

You will save between 50% and 85% in transaction fees with an accompanied increased profit margin of 7% up to 20% when choosing B2B Pay over a wire transfer from one of the 200,000 banks in Europe.

Trust, Investors

B2B has partnered with two prestigious financial institutions:

Nordea Bank, one of the biggest and most trusted banks in the world, with headquarters in Sweden, as well as Barclays Bank, a world leader in finance.

We have received funding from the Finnish government and from investors in Finland and the United States.

The founding team has broad and in-depth experience in both finance and technology, with a solid track record with companies such as AEGON, Mercedes-Benz and governmental organisations including the Dutch tax authorities and the New Zealand financial authorities.

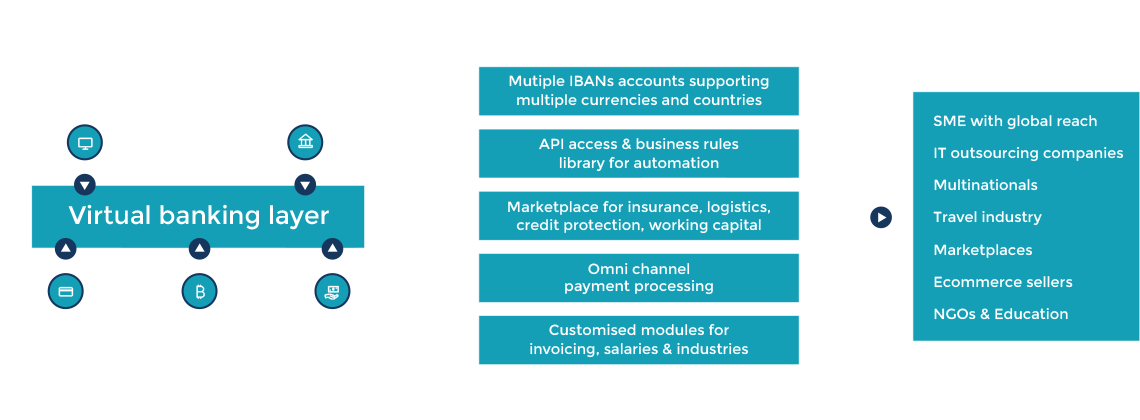

Our vision for non resident bank accounts

A global direct bank providing virtual banking for international SMEs & multinationals

- Mutiple IBANs accounts supporting multiple currencies and countries

- API access & business rules library for automation

- Marketplace for Insurance, logistics, credit protection, working capital

- Omni channel payment processing

- Customised modules for invoicing, salaries, industries

Our Story

In 2013, Neil was helping restructure a small pharmaceutical exporter in India, near Mumbai. He noticed that by the time the transaction was processed, the exporter had lost 20-30% of their gross margin due to international fees and currency conversion rates.

Hundreds of thousands of companies perform transactions with their customers in Europe. In almost all cases the payment is initiated at a local bank. The non-resident company carries all the costs related to the transaction.

B2B Pay uses the latest technology to save money and improve profitability for these companies. Our solution is 80% cheaper and faster than the current methods. Read more about us here.

Our team

B2B Pay is founded by Neil Ambikar and Kasper Souren. Both international travelers, speaking a combined 14 languages, their expertise is wide varied -- Neil has experience in business, finance and regulations, while Kasper is an expert in all facets of integration and implementation of web based businesses. In 2015, after almost a decade of friendship, Neil and Kasper decided to work on innovating global B2B payments.

Founder & CEO

Neil Ambikar

New Zealand

Email: [email protected]

A finance and business professional who has worked in four countries in the field of business advisory, tax, audit, restructuring and management reporting. Neil has worked as a bank auditor, interim CFO and is a registered chartered accountant in the UK, Australia and New Zealand and holds a degree in business.

Operations

Leonardo Bassani

Brazil

Email: [email protected]

Leonardo has a long track record with sales and marketing with internet businesses, working with organisations Red Bull, Nokia, Avaya Comm, the Red Cross and Miss America. Leo co-founded CouchSurfing.

Sign Up Process

1. Questionare

All countries have banking regulations. First, we need you to answer a few quick questions under the signup button such as your company name, industry and proof of business.

2. Non-resident company's information

If you're eligable for a B2B Pay account we send you a list of document and due diligence that is necessary to the two-step authentication process to ensure correct compliance.

- You upload the required documents related to your company and to your company's beneficiaries.

- We review these documents and provided information with the appropriate authorities.

Once the information is approved, you provide us with your local bank account details. We have strict procedures in place about changing these details.

If you are not eligible for a B2B Pay account we will suggest some of our partner companies that would be a great fit for your company.

2. Your own virtual IBAN and virtual bank account

As soon as the customer's due diligence checks are cleared, we issue you an IBAN number for your virtual bank account. Paperwork and bureaucracy are significantly reduced. You can use this IBAN on your invoices to European customers. When a payment arrives in the account we will inform you and send the money to your local bank account.

Your customer in Europe can make a simple SEPA payment. Euro payments in 36 European countries are handled without any fee (in most cases, or a nominal fee if there's a fee) and SEPA payments are usually settled the next business day. We have negotiated a deal with our FX partners to secure our customers the best deal.

We are very happy to hear from you if you have questions or comments. Check our FAQ or contact us through our website or give us a call.

How it works

-

Financial Technology

Financial technology, also known as Fintech, is a line of business based on using software to provide financial services. Financial technology companies are generally startups founded with the purpose of disrupting incumbent financial systems and corporations that rely less on software.

Fintech companies are taking parts of what banks are doing and optimising heavily.

They’re doing things that would have been impossible 10 years ago, that probably would have been impossible 5 years ago.

Business Insider: This is how a new crop of companies is trying to reinvent banking

This quote is about peer-to-peer lending, but the same story is happening throughout all functions of financial institutions. B2B Pay is focusing on international B2B payments because we are confident that we can innovate.

-

Reduced operating costs

Unlike banks we're not employing hundreds or even hundreds of thousands of people. We don't have big offices. Banks have many costly legacy processes. B2B Pay is a nimble organisation that mostly automates its work.

We needed a partner who could understand our needs and provide us with a solution to take payment in our customers' currency, in order for them to not pay high fees via banks and international wire transfers. B2B Pay is the perfect solution for our business: SEPA wire transfers are easy and fast. Our customers don't pay any additional fees and they get the best conversion rate! Our customers are very pleased with this solution, and so are we!

Thibaud Lucas, Experilang

-

Fast & flexible B2B money transfer

When it comes to building our company reliability comes first. Nevertheless we are still about a 100 times faster than any big bank when it comes to your B2B money transfer.

-

Virtual bank account for aggregation of funds

We're combining a large number of transactions, so that a 10k€ payment will actually be transferred for the rate of a 10M€ transaction. When you do smaller transactions the spread costs are much higher. Banks typically charge between 3-6% on international transactions and currency exchange for transactions up to 1M€, without explicitly telling you. If you enquire you will get the reply that the cost is "only" 30€ for an international transaction.

If you look deeper into this you see that the currency exchange happens at a price far from the mid-market rate.

Reviews