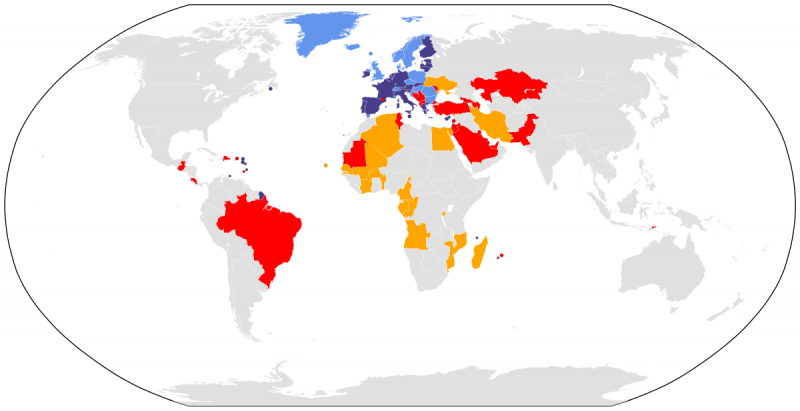

We can onboard companies from these countries:

Australia, Austria, Belgium, Bulgaria, Canada, Cayman Islands, China, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Guadeloupe, Guernsey, Hungary, Iceland, India, Ireland, Isle of Man, Israel, Italy, Japan, Jersey, Latvia, Lithuania, Luxembourg, Malta, Martinique, Mayotte, Monaco, Netherlands, Norway, Poland, Portugal, Reunion, Romania, Slovakia, Slovenia, South Africa, South Korea, Spain, Sweden, Switzerland, Taiwan, United Kingdom

In certain cases, We can onboard companies from these countries:

Argentina, Armenia, The Bahamas, Belize, Bermuda, Brazil, British Virgin, Dominica, Kuwait, Liechtenstein, Malaysia, Mauritius, Oman, Peru, Puerto Rico, Saint Kitts and Nevis, Saint Lucia, Saint Vincent and the Grenadines, Seychelles, Thailand, Turkey, Ukraine, United Arab Emirates, United States, Vanuatu, Vietnam, Virgin Islands, Aruba,Cook Islands, Costa Rica, Cote d'Ivoire

Currently, We can't onboard companies from these countries:

Afghanistan, Albania, Algeria, American Samoa, Andorra, Angola, Anguilla, Antigua & Barbuda, Azerbaijan, Bahrain, Bangladesh, Barbados, Belarus, Benin, Bhutan, Bolivia, Bosnia & Herzegovina, Botswana, Brunei, Burkina Faso, Burma, Burundi, Cambodia, Cameroon, Cape Verde, Central African Rep, Chad, Colombia, Comoros, Congo, Dem. Rep. Congo, Cuba, Djibouti, East Timor, Ecuador, Egypt, El Salvador, Equatorial Guinea, Eritrea, Ethiopia, Faroe Islands, Fiji, French Guiana, French Polynesia, Gabon, Gambia, Gaza Strip, Georgia, Ghana, Greenland, Grenada, Guam, Guatemala, Guinea, Guinea-Bissau, Guyana, Haiti, Honduras, Indonesia, Iran, Iraq, Jamaica, Kazakhstan, Kenya, Kiribati, Kyrgyzstan, Laos, Lebanon, Lesotho, Liberia, Libya, Macau, Macedonia, Madagascar, Malawi, Maldives, Mali, Marshall Islands, Mauritania, Mexico, Micronesia, Fed. St., Moldova, Mongolia, Montserrat, Morocco, Mozambique, N. Mariana Islands, Namibia, Nauru, Nepal, Netherlands Antilles, New Caledonia, Nicaragua, Niger, Nigeria, North Korea, Pakistan, Palau, Panama, Papua New Guinea, Paraguay, Philippines, Qatar, Rwanda, Saint Helena, Saint Kitts & Nevis, Saint Vincent and the Grenadines, Samoa, San Marino, Sao Tome & Principe, Saudi Arabia, Senegal, Serbia, Sierra Leone, Solomon Islands, Somalia, Sri Lanka, St Pierre & Miquelon, Sudan, Suriname, Swaziland, Syria, Tajikistan, Tanzania, Togo, Tonga, Trinidad & Tobago, Tunisia, Turkmenistan, Turks & Caicos Is, Tuvalu, Uganda, Uruguay, Uzbekistan, Venezuela, Wallis and Futuna, West Bank, Western Sahara, Yemen, Zambia, Zimbabwe