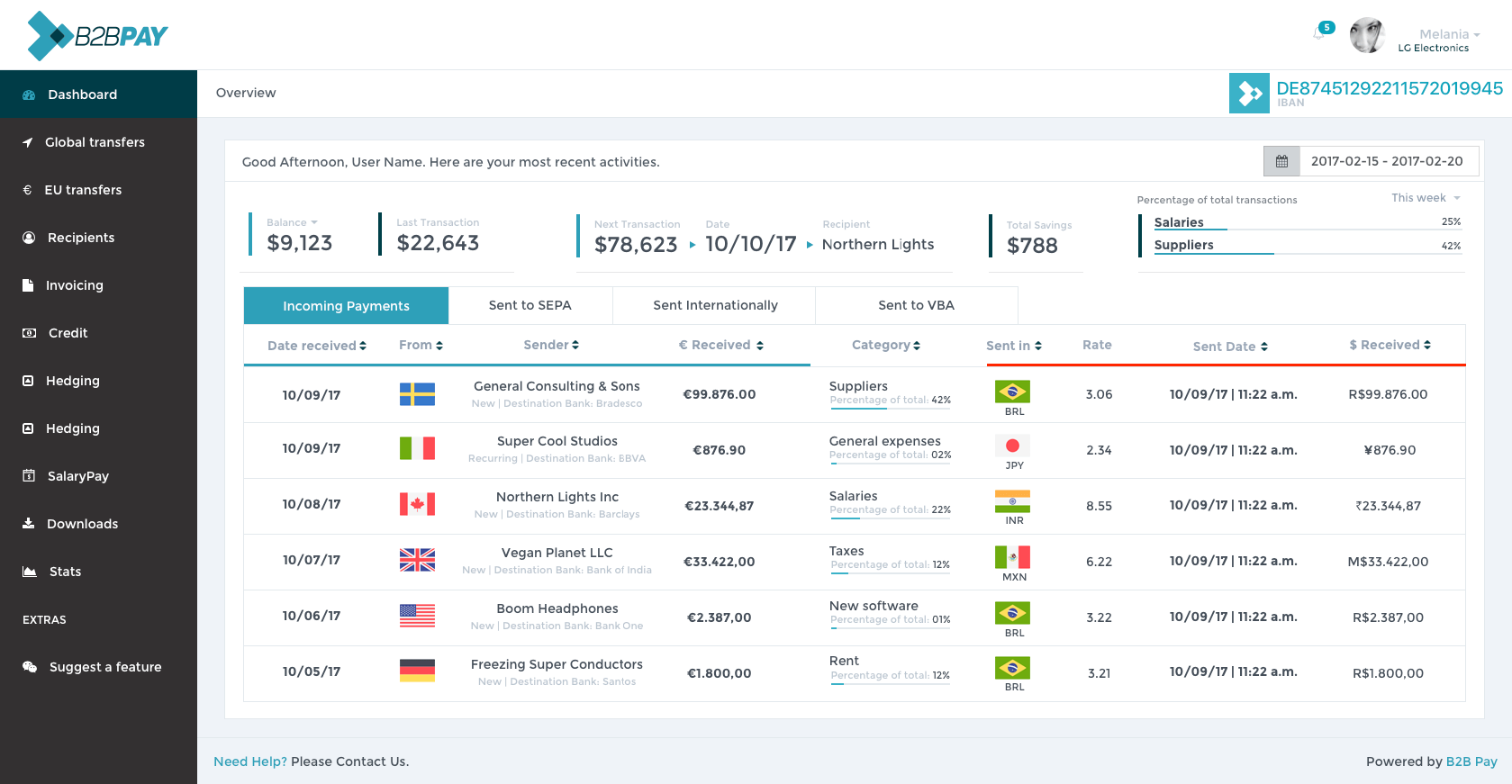

We make

B2B Payments cheaper

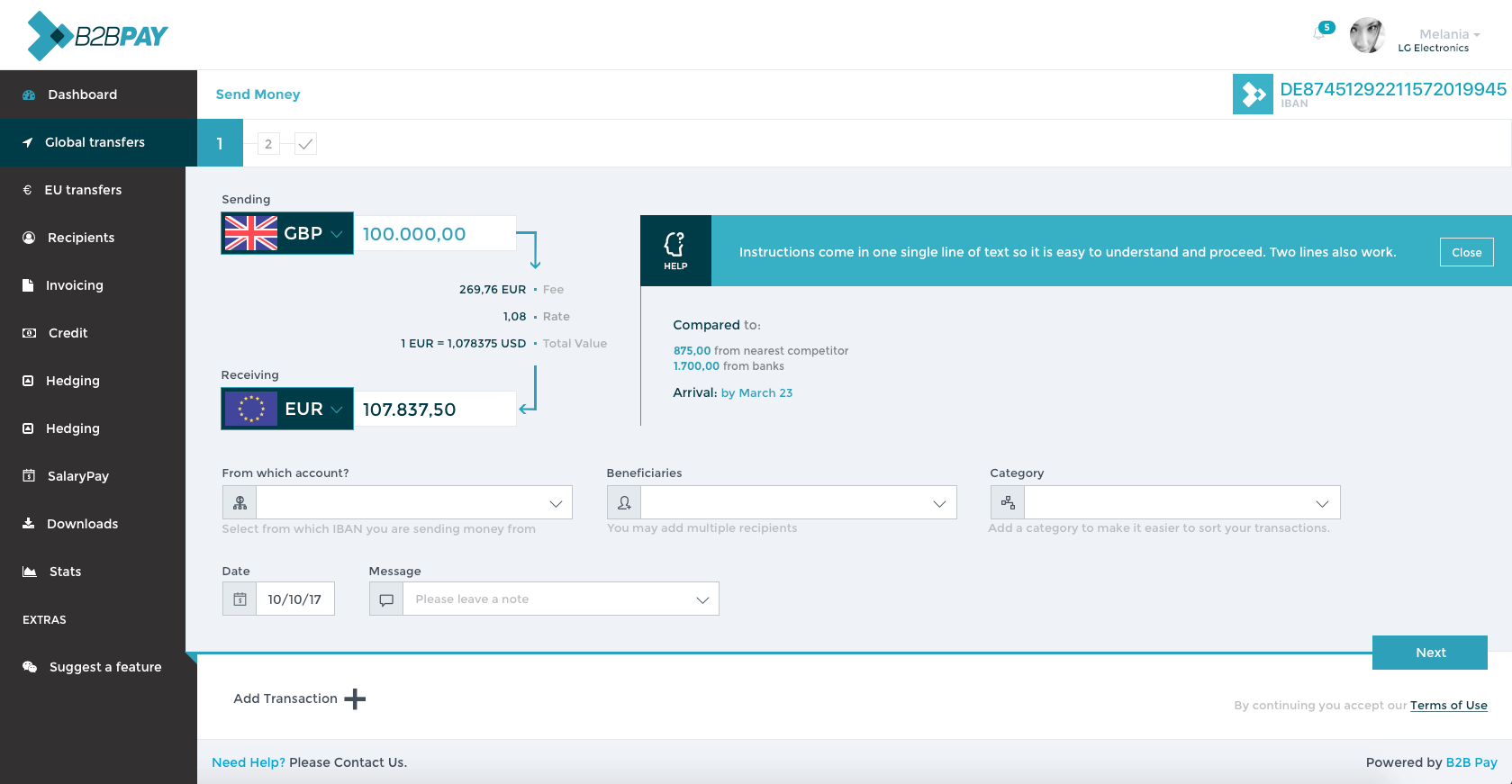

Stop losing ⅕ of your profits on fees and currency conversion now. Reclaim 20% of your margin when you’re getting paid. You deserve it.

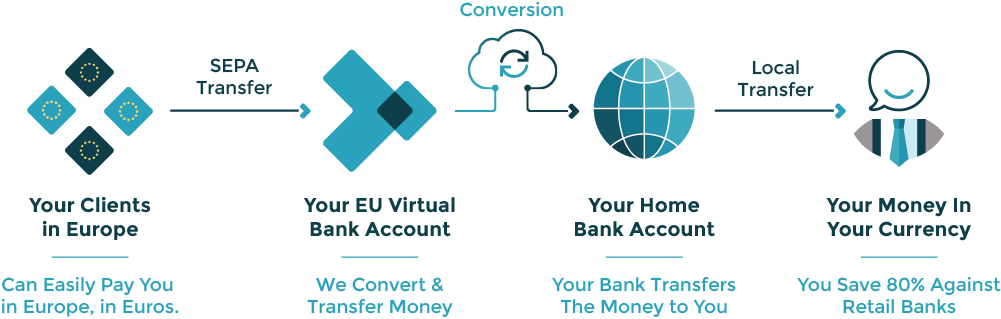

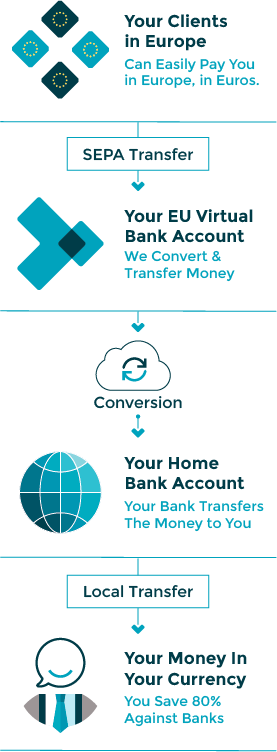

Currency conversion in 32 Global currencies

Make payment to 200 countries and save 80% compared to BANK